HSBC UK reveals 73% of Londoners understand debt consolidation but demand for financial education

HSBC UK survey finds consumers are confident in managing debt. Demand for financial education remains high.

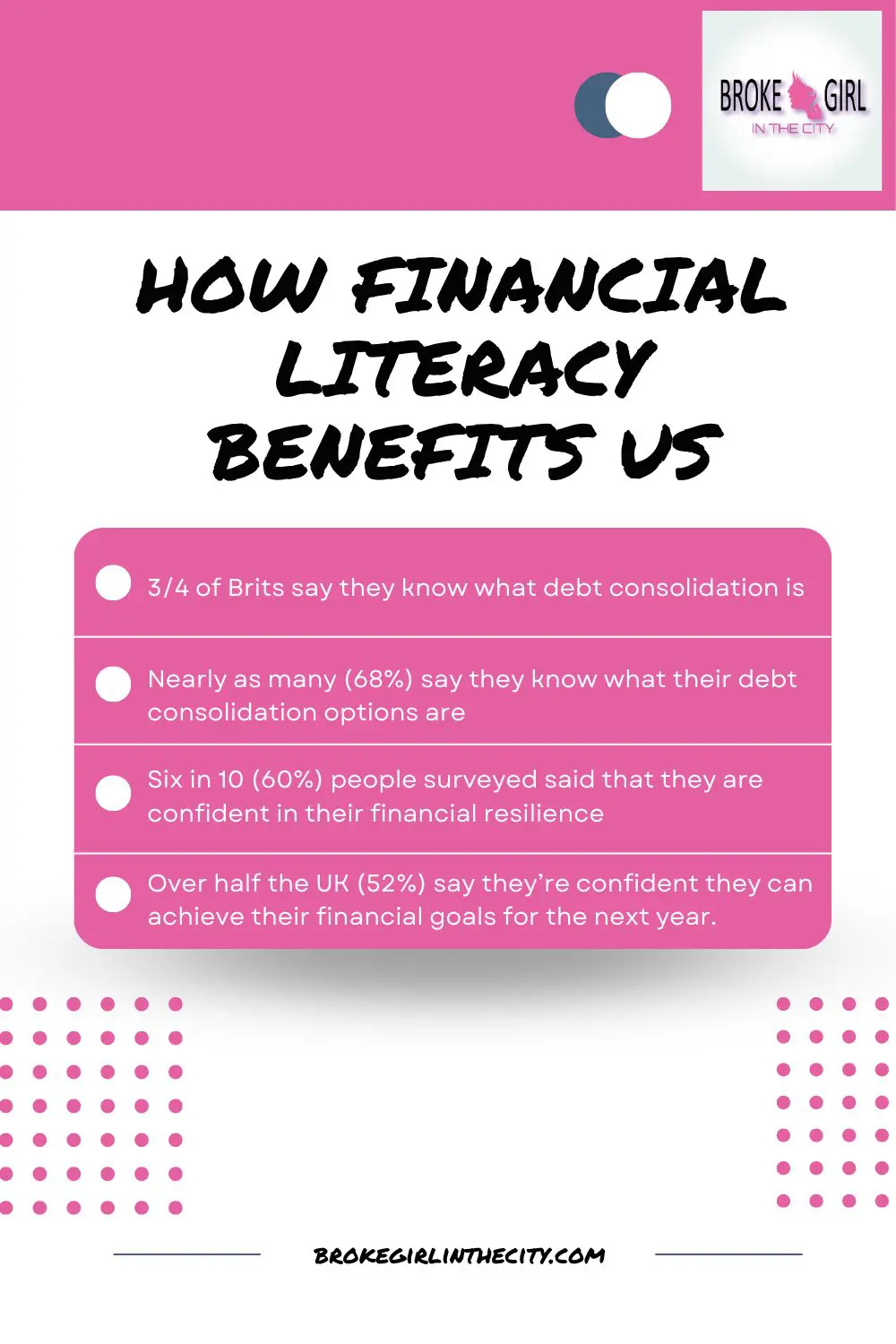

- Three-quarters of Brits say they know what debt consolidation is (74%) and nearly as many (68%) say they know what their debt consolidation options are

- Six in 10 (60%) people surveyed said that they are confident in their financial resilience and ability to handle unexpected financial expenses in the next 12 months.

- Over half the UK (52%) say they’re confident they can achieve their financial goals for the next year.

Research from HSBC UK indicates that consumers are generally confident in their ability to manage and review their debts. However, there is still a significant need for ongoing financial education to help bridge the gap between consumers financial goals and the resources available to them.

The survey findings highlight that three-quarters of Brits claim they know what debt consolidation is (74%) and nearly as many (68%) say they know what their debt consolidation options are, indicating an understanding of financial requirements.

Additionally, the research found that many consumers demonstrate a proactive approach to debt management. More than one in four (28%) note they review their approach to managing their debts once a month, with nearly one in five (18%) doing it once a week.

Despite these positive indicators, the survey found many express a desire for more guidance in understanding debt options and achieving long-term financial goals. Only one in three say they fully understand what options are available (34%) and only just over one in five (23%) have contacted their bank or building society to investigate these options.

Furthermore, while 70% of people know the difference between unsecured and secured debt, only just over half (54%) of 18-24-year-olds say they understand it. Younger adults are also much less confident than the rest of the population that their debts are manageable (37% v 65%).

Those surveyed note they get financial advice from family and friends (26%) first and foremost, followed by consumer finance publications (24%) and their bank (21%).

Key London findings:

- Debt awareness: 73% of Londoners understand debt consolidation, and 67% know their consolidation options.

- Financial resilience: 67% feel confident in handling unexpected expenses over the next 12 months.

- Goal achievement: 59% are confident they can achieve their financial goals for the next year.

Despite these positive indicators, the survey reveals significant gaps across the UK:

- Only 34% of Brits fully understand their debt options, and just 23% have consulted their bank for advice.

- Younger adults (18-24) show less confidence in debt manageability (37% vs. 65%) and have a lower understanding of secured vs. unsecured debt (54% vs. 70%).

Survey reveals top three ways Brits would like help managing their finances:

- Understanding how to make their money go further – 24%

- A better understanding of their options – 18%

- Taking responsibility themselves to find out more – 18%

Although many respondents feel confident about debt consolidation and managing finances, they still seek clearer guidance for long term goals and are open to bank assistance, especially young adults. While advice often comes from family, friends, and financial publications, there’s a strong opportunity for banks to offer tailored support.

Madhu Kejriwal, Head of Unsecured Lending at HSBC UK said: “Our priority is to ensure our customers understand their financial options and make the right decisions for their personal circumstances. While many consumers are aware of their debt consolidation options, only one in three fully understands their choices and engages with their bank to explore them. This is why we have trained specialists to help our customers make better financial decisions, understand their options, and improve their financial well-being.

HSBC UK’s trained specialists help individuals understand their financial options, optimise their finances, and work towards their long-term financial objectives. Debt consolidation loans can be a helpful tool for individuals looking to streamline their debt payments and simplify their financial management.

HSBC UK

HSBC UK serves over 14.7 million active customers across the UK, supported by 23,700 colleagues. HSBC UK offers a complete range of retail banking and wealth management to personal and private banking customers, as well as commercial banking for small to medium businesses and large corporates. HSBC UK is a ring fenced bank and wholly owned subsidiary of HSBC Holdings plc.