10 Great reasons to join Starling Bank

This post is sponsored by Starling Bank, but all views are my own. I received compensation as a thank you. This post reflects my personal opinion about the information provided by the sponsors.

I have heard great things about Starling bank from a number of people. So it seemed an obvious choice when looking for another bank to use for my freelancing gigs this summer. I like to have separate accounts for different usages, to monitor my income and expenses.

Starling Bank provided information about their accounts so that I could offer you a detailed overview of the services they provide. I decided to sign up for a personal account, but they do offer a business account, both of which have great benefits.

What is Starling Bank?

Starling Bank is an award-winning and fully licensed digital bank founded by Anne Boden. All of Starling’s accounts are protected up to £85,000 by the Financial Services Compensation Scheme…so your money is quite safe!

What I really like about Starling, is its commitment to ethical banking and the environment.

Starling’s mission is to make banking better for everyone. At the core of Starling’s value system is a belief in transparency, fairness and inclusion, which means no hidden or rip-off fees and a commitment to listening to their customers. 90% of Starling’s cloud spend with AWS is with the Dublin data centre, which is carbon neutral.

There are five different account types:

●. Personal ● Business ● Joint ● Euro ● Sole Trader

Plus a child space in the app and a child card called Kite. Something great for any families reading this.

Starling cards made out of recycled plastic

Starling is the first bank to issue recycled bank cards to customers, which is reflective of their commitment to ethical banking and the environment. Something we are all increasingly becoming more conscious of.

Some of the environmental benefits are listed out below:

● Trillion Trees partnership means that if you refer someone to Starling then a tree is planted

● Paperless banking / no branches.

● 100% renewable energy in our offices in London, Southampton and Dublin. Plan to move 100% renewable energy in Cardiff

● 90& of Starling’s cloud spend with AWS is with the Dublin data centre, which is carbon neutral

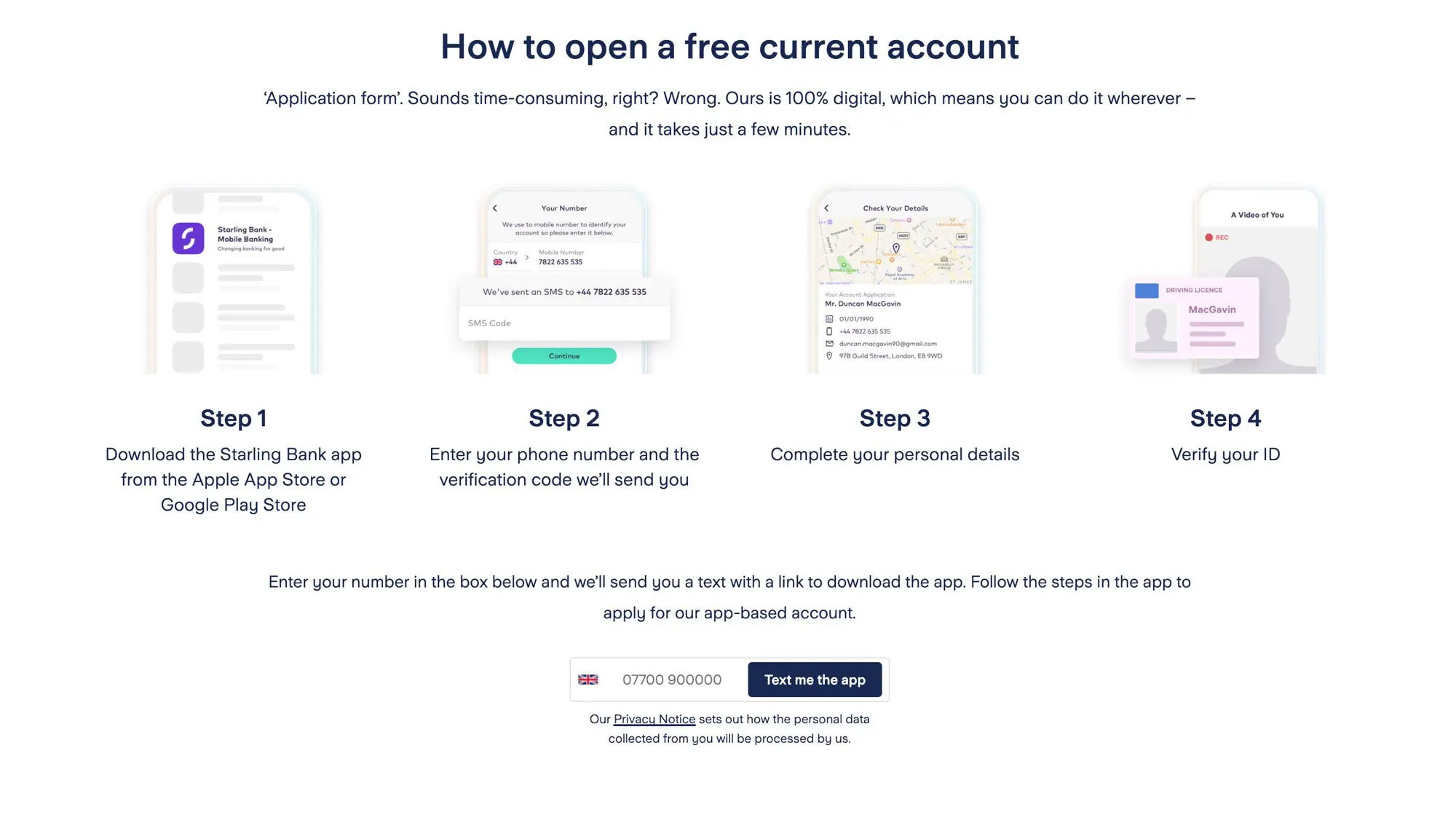

Starling – how to open a free current account

It is extremely easy to set up a free current account. I downloaded the app from the Apple App Store to get started and entered my phone number to verify my account. Once I set up my details I had to talk in a video, which might seem strange but they ask to verify your identity after submitting your identification details.

Starling App – How to navigate your way around

I found it quite easy to sign up for the app, and my card was sent to me within days. The app as you can see above has 5 sections to navigate between.

Home: Mobile homepage shows your total spending amount in the month.

Payments: You can view your payments, as well as those which are scheduled. You can ‘Request Money’ and ‘Send Money’ using the app.

Nearby Payments: You can pay or get paid by other Starling customers when they are nearby. Useful for those meals out! Alternatively, you can send them a payment request link.

Spending: You will be able to view spending by category or by the merchant, and by month.

Card: Your debit card is stored in the app and you can add your card to Apple Wallet.

How to analyse your spending

Starling makes it easy to save up for the things you want by setting money aside for your ‘Goals’ in the app.

You can also see where, when and how you’re spending – and how you could budget more effectively. Something we can all benefit from as we are going ‘out out’ more!

Starling Spaces

Interestingly, you can create Goals to help you save for things and experiences that matter to you. You can also connect someone to your account and assign them a card, as well as give your kids a Kite card to help them learn about money.

Start by creating a ‘New Space’ – giving yourself a goal – and a financial limit. You can then choose whether to make regular transfers to your space to help you save for your goals. You can also opt in to round up your spending to contribute to your savings goal.

Starling Business Account

You can apply for a free digital business account easily within the app. You heard that right…it’s free! No monthly charges, which help when you are just setting up a business.

Starling is a fully regulated UK bank account. Your money is covered up to £85,000 by the Financial Services Compensation Scheme with free 24/7 UK support. What’s more, the bank integrates with the likes of Xero, QuickBooks, FreePost and offers in-app and Freepost cheque deposits.

Starling also offers add-on services with enhanced services such as The Business Toolkit (£7/month inc VAT), Euro business account (£2/month) and the US dollar business account (£5/month).

10 Great Reasons to join Starling Bank

- Starling cares about their customers: Starling’s mission is to make banking better for everyone. You can see this reflected in their lack of fees and 24/7 customer service

- Ethical Banking: Starling has adopted an ethical approach to investing money. They do not invest in environmentally or socially damaging industries including fossil fuels, tobacco and arms manufacturing. Starling invests in high quality liquid assets including gilts and bonds.

- Good for the environment: Starling is the first bank to issue recycled bank cards to customers. Their Trillion Trees partnership means that if you refer someone to Starling a tree is planted so you are doing your bit to help the environment.

- Spending analysis: A huge benefit for all of us. You can view your spending habits and also set money aside for your ‘Goals’.

- Instant Notifications: Whenever a payment leaves or enters your account, Starling lets you know immediately. Great for knowing what’s coming out of your account and security!

- Split, send and receive payments: This feature is really good for house shares or in couples, when you need to split the bills. As well as request or send money to other people.

- Nearby Payments: Find and pay fellow Starling customers from your mobile without needing their details.

- Settle Up: Manage your payments with one single link from your mobile. Splitting the bill has never been easier

- Round Ups: You can round up transactions to the nearest pound, put the change into your savings and before you know it, you’ll have a nice pile of extra cash without even trying!

- Card Controls: Lost your card? Don’t worry, you can lock it. Great for people like me who lose their card on a weekly basis in the house! You can manage everything from the app, which is a huge benefit.

Banking on It: How I Disrupted an Industry

Founded by Anne Boden, Starling is the first British bank to be founded by a woman. I have recently read her story, which is so inspiring. It was Anne who recruited Tom who went on to found Monzo Bank. so Anne proved to be quite the pioneer in her sector!