Stay on track with your spending with the app Plum

I am always trying to find better ways to save money and invest. Given the instability of the economy and the job market at the moment, as well as the constant threat to our personal finances. I am more careful about my finances than ever.

I downloaded the app Plum this month, which has been incredible. I have managed to link up all of my personal bank accounts and credit cards to the app, so I can see at a glance how much money I have in each account, and also how much I owe on credit cards. I am a huge fan already!

Plum sent me all of these guides to the app and its features to share with you all. I wanted to offer a comprehensive view of the app, as well as recount my personal experiences. You can download the app using the link below to get started.

In full disclosure, if any of you download the app, I might get an affiliate payment from Plum at no cost to yourselves if you download the app using this link.

Plum builds a complete picture of your finances to save you money, help you budget, and set money aside, even when you’re not thinking about it.

Automate your Deposits

Plum’s AI tucks money away: a little but often.

Connect your banks so Plum can adapt to your spending, calculating how much to set aside, without you needing to think about it.

Putting money aside like this can be more effective than traditional methods, and many more “Plumsters” are surprised to see their balance.

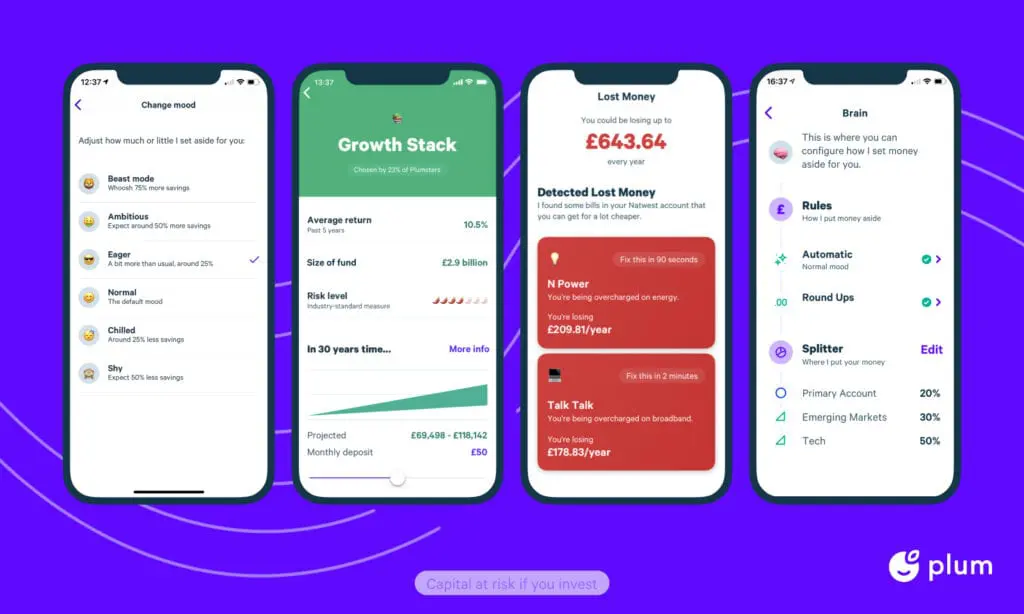

Find Lost Money

Plum identifies if you’re overpaying on bills and can switch you to a better supplier in seconds.

By referencing your outgoings against .e.g utility tariffs in your area. Plum identifies whether you’re not overpaying for things like gas or electricity.

When I clicked on the Lost Money section it told me that I could be losing around £821.12. Quite a large sum of money! So I clicked on this feature to take a deeper dive into the amounts.

Review: Plum suggested I take out a cheaper loan to pay off my credit card. Admittedly this card does have a high APR, and I have been guilty of not paying this off in full these past few months. However, I will be paying this off at the end of the month. If you choose to go down this route, don’t then run up your credit cards once more, as you will then have two payments to pay off.

The other cost savings are for utility bills, which I am not responsible for at my house. However, this doesn’t mean to say you shouldn’t look at all of your bills to understand how you can get these cheaper.

The other two options are for ‘Purchase Cards’ or ‘Balance Transfer Credit Cards’ with MoneyGuru, which means you can either find a 0% Purchase Credit Card (great for buying one-off items) or you can transfer your credit card balance to another provider with 0% interest on transfers for a certain period, although there will be a transfer fee. You can check your eligibility before applying.

Cashback

‘Cashback’ rewards you when you shop with one of their partner brands through the Plum app. When I went to access this, it showed me that it is a feature of the PRO subscription.

Exclusive Deposit Rules

Premium customers also can get access to additional, fun rules, which harness recent Behavioral Science research, and use intelligent personalization to he[p score your goals quicker. I am going to get used to the app this month, before upgrading.

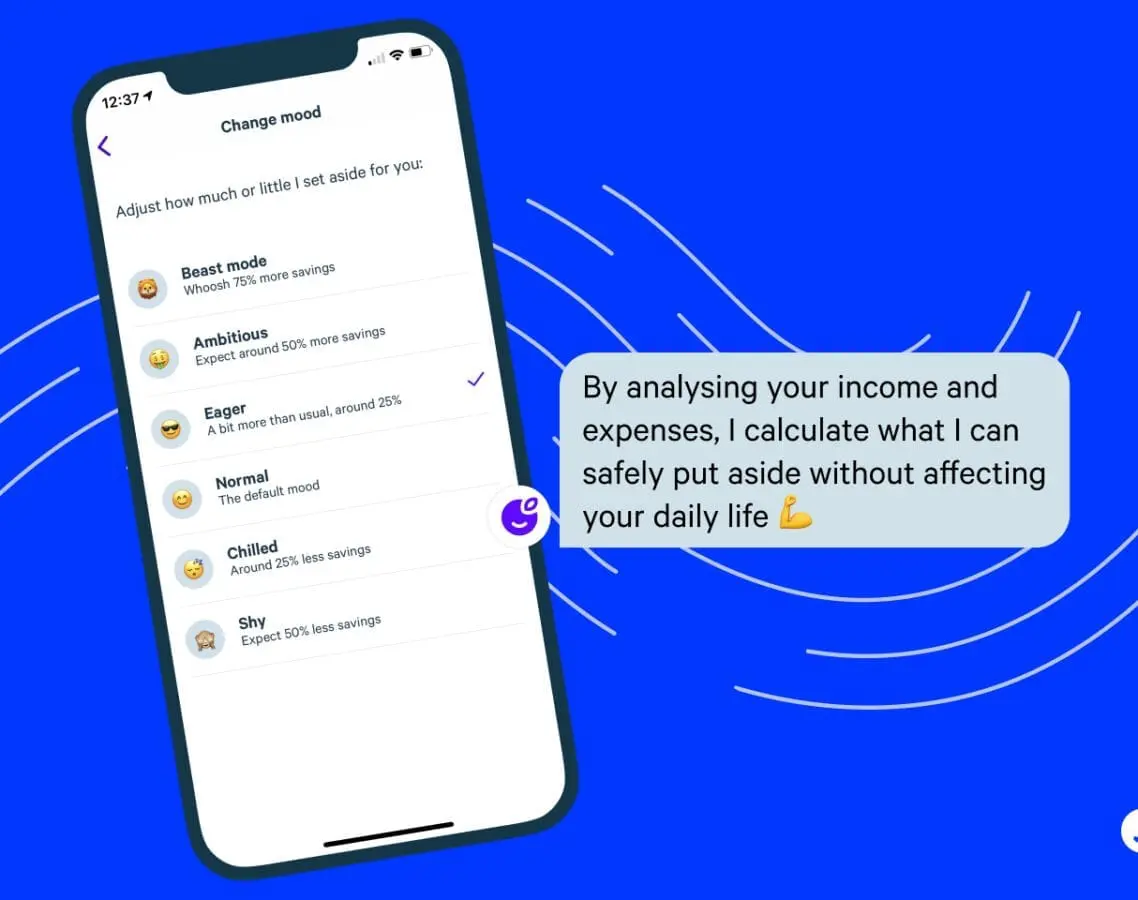

Can I adjust how much Plum is putting aside for me?

Sometimes we want to save, but at times want to be careful of how much money is leaving our account. Alternatively, you may be wanting to accelerate the speed at which you save your money. Plum lets you adjust your spending ‘moods’ – see information below on how to adjust these settings.

Review: I have set mine to ‘Eager’ as I want to save for an emergency fund. I am minimising any other going out activity at the moment, other than going to work. I do like the fact that you can adjust the settings, although you can’t seem to cap the amount you save so watch your bank balance. I have a daily reminder each day sent to me from Plum to tell me how much money I have across all of the banks which I have linked to the app. I love this feature.

In Messenger:

To adjust how much Plum puts aside type ‘mood’ or select ‘update mood’ on the home menu.

In the iOS App:

Click on the Plum icon. From the Home page tap ‘Brain’. Under ‘Rules’ select ‘Automatic’. From there you can tap ‘Current mood’ to update your mood.

—————

By default, Plum’s mood is

– ‘Normal’.

If you want to put more aside, you can change it to:

– ‘Eager’ (25% more)

– ‘Ambitious‘ (50% more).

– ‘Beast Mode’ (75% more).

If you want to put less aside, you can change it to:

– ‘Chilled’ (25% less)

– ‘Shy’ (50% less).

Rainy Day Savings Rule

A rainy day savings fund is meant as a safeguard for shorter-term and lower-cost struggles, like home maintenance or parking tickets. An emergency fund is for when you lose your job or there are specific costs that you haven’t budgeted for. You should aim for 3 months’ living expenses, which has always been a dream for many of us!

It’s so important to build up an emergency fund and squirrel away money. If you feel you can’t save money, you can. Even if you save £1 a month…it’s something.

Both the Rainy Days and 52-Week Challenge are features of their PRO Account, which is available at £2.99 per month.

52-Week Saving Challenge

The ’52 Week Challenge’ is not for the faint-hearted. Each week it’ll save £1 more than the previous week! That’s a total of £1,378 over the course of a year. Each week on the calendar corresponds to more cash in your Plum pocket. Many people don’t even earn that much in a year but don’t despair. Read my article on how to build up an emergency fund, even on a budget.

Earning interest on your Plum savings

You can now earn up to 0.55% interest on your savings with Plum’s new interest ‘Pockets’. There are other savings on the market with more competitive rates but this doesn’t seem a bad choice if you would like to see everything at a glance.

Unlike the money stored in your ‘Primary Pocket’, which can be accessed within 24 hours (usually within 20mins). You can provide notice of 1 working day when you want to withdraw money from an Easy Access Interest Pocket.

Plum launches new ‘Interest Pockets’ at 0.35% AER in response to COVID-19 saving boom

- Plum aims to effortlessly build wealth in a smart money-management app.

- All Plum customers will be able to save into an Easy Access Interest Pocket for free.

- Interest Pockets are covered by the FSCS and provide interest at 0.35% AER.

- Savings have boomed during the COVID-19 outbreak as spending dropped.

Splitter & Pockets / Goals

To help you organise your money, you can set up separate savings pockets within your Plum account, and assign specific goals to each pocket that you can work towards.

When used with the ‘Splitter’ you can automatically apportion deposits between pockets.

Review: I have decided to split my deposits between a ‘Primary Pocket’ (50%), an Emergency Fund Pocket (30%) and then also I have decided to invest in the ‘Tech Giants’ portfolio (20%). You can find these under the ‘Brain’ section. I am not advising on how you should save or invest your money, as you must do some due diligence before committing to investing of any kind. I have also chosen the Legal & General Fund, which is a Stocks & Shares ISA.

Pay Days

Paydays are an opportunity to deposit an additional lump sum to your Plum account when your salary first hits your bank…but before life has a chance to get in the way of your best intentions!

Review: I am a massive advocate of automating all bills and savings on Pay Day. I have committed to saving £175 each payday, so let’s see how I get on!

Plum Diagnostics

Plum Diagnostics’ delivers a monthly report that categorizes spending by allocating it into groups like Groceries, Shopping, Eating Out, Entertainment and Transport, This means that you can easily see where your money’s going at a glance and identify trends. I love this feature in Monzo and my spending app.

You can also benchmark your spending against other users with a similar financial profile (based on factors such as salary, location, and age). This allows you to see ‘best practice’, and take action to improve over time.

True Balance

Plum ‘True Balance’ helps you manage your money better, by calculating how much of your available balance is safe to spend…once any regular payments due before your next payday have also been accounted for.

Plum Account

(Excluding Interest Pockets)

Plum is an electronic money agency of PayrNet. Customer funds are held in electronic money wallets on the app. The customer’s funds are held in a pooled account with the bank of choice of Plum’s Partner, which is protected by the E-Money Safeguarding Rules.

That same safeguarding also prevents any of Plum’s or Payrnet’s creditors from claiming your money in the event that either business should go bankrupt.

Interest Pockets

Money saved with Plum in these interest Pockets is held on Trust with a UK Bank. A Trust is a legal mechanism which means we can look after your money, but legally it never stops belonging to you.

If anything were to happen to Plum then the bank can return your money to you directly. And should something happen to the bank itself, then (because you are still the legal owner of the money) you could benefit from the FSCS and claim up to £85,000 of your money back from the bank if the scheme applies to you.

Why Plum and who are they?

Nearly ⅔ of UK adults (63%) say that stress over money has affected the mental health or well-being of someone they know (MaPS, 2018) less than 11.5m people in the UK have £100 in savings (MaPS, 2018) 4bn is lost every year because we’re too loyal to our bill providers, around £900 per household (CMA, 2018) ~90% of UK savings accounts pay less than inflation (Which, 2019) UK households saved 37 billion in 2017 – the least since 2011. They borrowed 80 billion! (ONS, 2018)

Plum is…

The app that gives your money that ‘look, no hands’ feeling