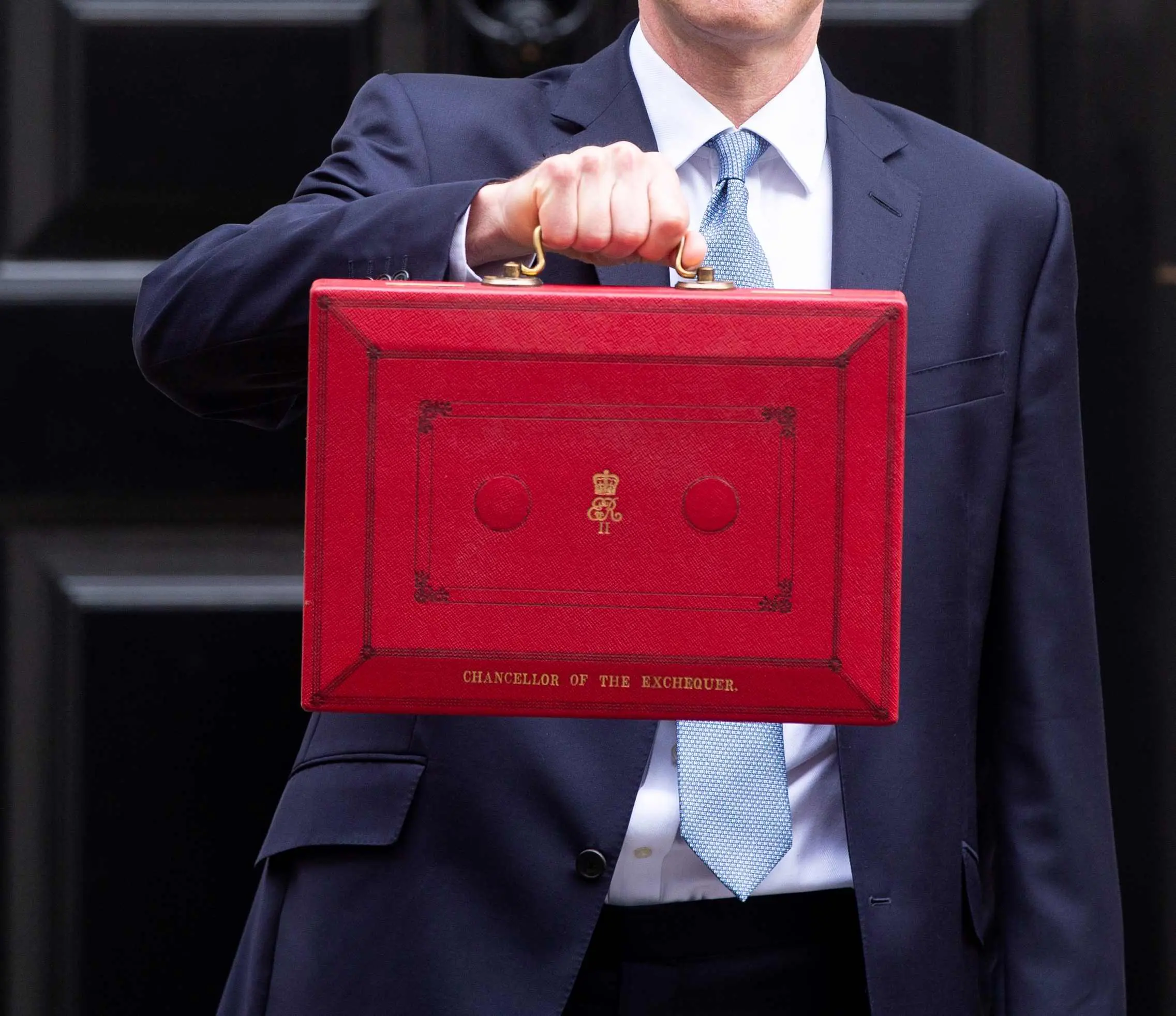

Spring Budget 2024 – Your ten key takeaways & what you need to know

- National Insurance cut could save you £754, but it’s not quite what it seems.

- There’s disappointment as investment tax allowances don’t move.

- There will be a consultation into a new British ISA.

- Hunt confirmed the NatWest share sale in the summer.

- He unveiled a British savings bond – fixed for three years.

- NS&I has been charged with raising less money next year.

- There’s a fairer deal on child benefit for singles and those caught by fiscal drag.

- The government committed to lifetime pension pots.

- Your vices will cost you dear.

- There’s relief for motorists as fuel duty is frozen.

Sarah Coles, head of personal finance, Hargreaves Lansdown:

“Jeremy Hunt decided to forgo the rabbit and the hat at the dispatch box in favour of a juggling act. Prioritising a National Insurance cut left him working furiously to generate cash through spending cuts and other tax hikes. It means we’ll be left with a financial juggling act, with National Insurance cuts balanced against income tax threshold freezes. Fuel duty cuts ease the burden on one side, while hikes in other duties will mean painful extra costs for some.

For investors, the news was mixed. We welcome the consultation with the British ISA. Unfortunately, there was no reprieve from cuts to capital gains tax and dividend tax allowances planned for April. Disappointingly, there was no rise in the ISA allowance, which would have helped support the government’s investment agenda.

National Insurance cut could save you £754, but it’s not quite what it seems.

Any tax cut will help ease the burden. The 2p National Insurance cut will make a real difference to how much working people have in their pockets. The more you earn, the more you save. So, while a higher-rate taxpayer will save £754, someone on a salary of £30,000 will save £349 a year—or £29 a month.

However, this comes alongside the notorious freeze in the personal allowance and the higher rate tax threshold. So, more people will be paying higher tax rates when you factor them both in. Higher earners are still better off, but those earning less than £19,000 will be worse off. Meanwhile, pensioners, who have gained nothing from these cuts, will also be counting the cost.

Disappointment over tax allowances

The decision to postpone the capital gains tax and dividend tax thresholds in April is as predictable as it is disappointing. They will fall to a miserly £3,000 and £500, respectively, So it’s hard for investors to plan tax-efficient income and gains outside an ISA or pension. It’s a frustrating move in the face of plans to encourage UK investment. This new tax blow will make it even more essential to consider using your annual allowances – including your ISA.

The capital gains tax cut on property will slightly boost property investors. However, it still remains one of the least tax-efficient ways to invest—not least because the stamp duty rules for those buying multiple dwellings will be abolished. Investors still pay taxes going in, such as a tax on rental income. More tax is paid on sales than on profits from investments.

Yet again, there was no change to the ISA allowance – aside from the consultation of a £5,000 rise with the introduction of a British ISA. So far, it hasn’t shifted since 2017 and would need to be hiked to over £27,000 to keep pace with inflation. It means we either have to save or invest a smaller proportion of our income each year, or we’re exposed to an increasingly harsh tax environment.

Consultation into a new British ISA

Hunt announced a consultation on a British ISA. ISAs are popular ways for people to invest for the first time. During the consultation, we will explore how best to support people’s investment in British companies. The ISA framework must be kept simple.

Confirmation of the NatWest share sale in the summer

There is likely to be strong interest in the NatWest share sale, the highest-profile public share offer since the Royal Mail IPO more than a decade ago. Allowing retail investors to own a slice of NatWest is a welcome move,.

A British savings bond – fixed for three years

The British Savings Bond from NS&I will offer a guaranteed savings rate over three years. All eyes will be on the rate available because even savers who want to buy British with cash will not want to accept a disappointing rate in return.

The Bank of England is set to cut rates in the coming months. Savers will need to consider carefully whether they want to wait for this bond or fix it now while they can still secure a great rate.

It’s also worth noting that most savers are currently choosing easy access and shorter-term fixed rates. This is partly because three-year bonds generally offer lower value than shorter fixes. Given that this is a three-year bond, it will need to be a very attractive rate to inspire much interest from savers.

NS&I has been charged with raising more money next year

NS&I’s net financing target has been raised to £9 billion. However, given that it raised more than this in the last tax year – at £10.9 billion, it may not be the shot in the arm that savers may have hoped for. Given that it needs to raise less cash and the backdrop of expectations that the Bank of England will start cutting rates in the coming months., The next move for these bonds will likely be a cut. This is generally bad news if you hold premium bonds because it could mean a cut in the prize rate, which will ultimately mean Premium Bond savers stand a lower chance of winning a prize. The expected funds raised from the Green Savings Bonds were also cut from £1billion in 2023-24 to £0.5billion in 2024-25, so these are unlikely to get much more generous.

There’s a fairer deal on child benefit for singles and those caught by fiscal drag.

The government will consult on changing the higher-income child benefit charge to a household basis. The child benefit rules that penalised single parents were always incredibly unfair.

In the interim, starting this April, the threshold will be raised from £50,000 to £60,000, and the top level of withdrawal will be £80,000. This will be welcome after a decade of being rooted to the spot, but there was scope for a more significant rise. If it had risen with average wages since it was introduced in January 2023, it would be £71,774.

One of the easiest ways to take yourself out of the child benefit trap is to pay into a pension.

The government committed to lifetime pension pots.

However, we can’t expect anything overnight. It has committed to exploring and introducing the model in the long term. In the interim, we must work harder to track multiple pots as we change jobs.

Your vices will cost you dear.

Last year’s alcohol duty rise was delayed until August, and this one has been frozen until February 2025. It would otherwise have increased by 3%, but tobacco duty will rise with inflation. There will also be a consultation on a vape tax to be introduced in October 2026. At that point, there will be a one-off rise in tobacco tax.

There’s relief for motorists as fuel duty is frozen.

Fuel duty hasn’t risen with inflation since 2011, so a freeze is usually nailed as soon as the maths behind the Autumn Statement emerges. This time, a 13% rise has been hanging in the balance because Hunt didn’t commit to it in the Autumn Statement. So it’s a massive relief for motorists that duty has been frozen and the 5p per litre discount has been extended for another year. It’s expected to avoid a £50 rise in driver costs over the next year. Fuel prices may have come down from the highs of summer 2022. However, they’re still significantly higher than before the last few months of 2021 before the invasion of Ukraine.”