Help to Buy: ISA Last chance to open one this Saturday.

Deadline: Saturday 30th November 2019

If you follow Martin Lewis from MoneySavingExpert you will have seen that he is warning that it is your last chance to open a help-to-buy ISA, at midnight on Saturday,

Whether like me you feel that you are generation rent and buying your own property might seem a dream rather than a reality. Or whether you have been saving to get on to the property ladder. Then read on.

Investing in a Help to Buy ISA might be the route to market you have been looking for. Even if your finances and credit score are not feeling up to the challenge. It doesn’t hurt to look into this while the opportunity is still up for grabs.

When is the deadline?

You have up until midnight Saturday 30th November to apply for a Help to Buy ISA. You can open one with a very small sum of money. The only stipulations are that you are 16 years and over and have a valid national insurance number (NI).

If you have already opened a Help to Buy ISA (or do so before 30 November 2019), you will be able to continue saving into your account until November 2029.

What is a Help to Buy ISA?

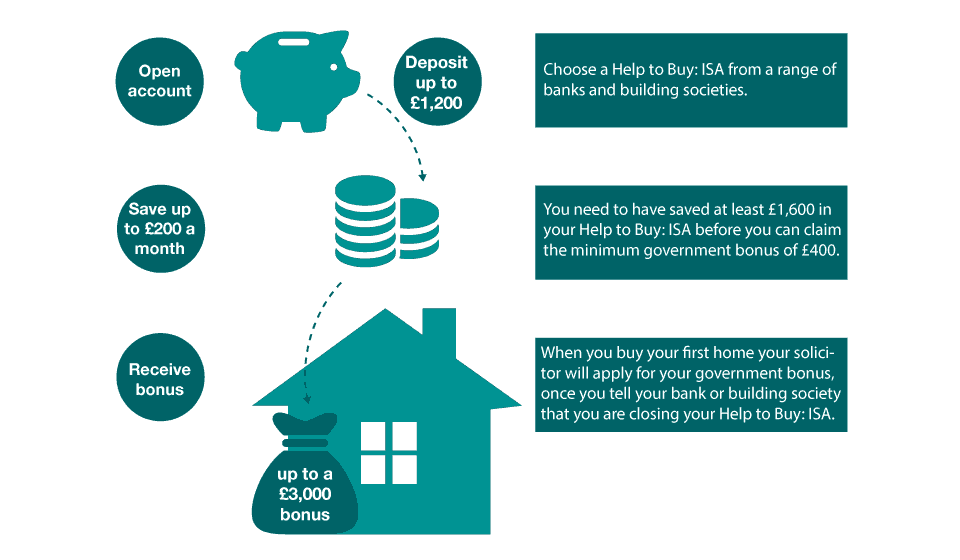

A Help to Buy ISA is a savings scheme to help you save for a mortgage, where you can get a financial contribution from the government should you meet their requirements.

How does it work?

If you are saving to buy your first home, save money into a Help to Buy: ISA and the Government will boost your savings by 25%. So, for every £200 you save, receive a government bonus of £50. The maximum government bonus you can receive is £3,000.

Where can I apply?

Many banks, building societies are all offering a Help to Buy ISA. If you are not a customer you may have to set up a meeting in a branch. However, if like me you are a customer of a bank, you can go to the app/online to open one up without further delay.

Who is eligible for one?

The accounts are available to each first-time buyer, not each household. This means that if you are planning to buy with your partner, for example, you could receive a government bonus of up to £6,000 towards your first home.

- be 16 or over

- have a valid National Insurance number

- be a UK resident

- be a first-time buyer, and not own a property anywhere in the world

- not have another active cash ISA in the same tax year: If you have opened a cash ISA this tax year, you can open a Help to Buy: ISA but will have to take additional steps.

How much do I need?

I managed to open a Help to Buy ISA with just £25 applying through my Barclays mobile app.

According to the Government website, you can save up to £200 a month into your Help to Buy: ISA. To kickstart your account, in your first month, you can deposit a lump sum of up to £1,200. However, that’s not to say you have to allocate that much at the start.

The minimum government bonus is £400, meaning that you need to have saved at least £1,600 into your Help to Buy: ISA before you can claim your bonus. The maximum government bonus you can receive is £3,000 – to receive that, you need to have saved £12,000.

How to calculate your bonus

This scheme will provide a bonus from the Government provided you have savings of at least £1,600. The bonus will be 25% of your savings up to a maximum bonus of £3,000.

Help to Buy ISA Calculator:

- Savings below £1,600 – You do not have sufficient savings for a bonus

- Savings between £1,600 and £12,000 – The Government will top up your savings by 25%.

- Savings over £12,000 – The Government will top up your savings by £3,000.

What to do when you are ready to buy?

When you are close to buying your first home, you will need to instruct your solicitor or conveyancer to apply for your government bonus. Once they receive the government bonus, it will be added to the money you are putting towards your first home. The bonus must be included with the funds consolidated at the completion of the property transaction. The bonus cannot be used for the deposit due at the exchange of contracts, to pay for solicitor’s, estate agent’s fees or any other indirect costs associated with buying a home.

Help to Buy ISAs: Who to choose?

Due to the fact that the deadline is imminent, it is quicker to go through your existing banks although this is not a requirement. MoneySavingExpert has provided a summary of who is still offering an ISA this week.