Awful April is nearly here…

So let’s talk budgets & money

We need to talk. About that dreaded ‘b-word’. Budgets – that is.

Whether your finances were de-stabilised last year like mine due to a change in employment circumstances or whether you have managed to save during the pandemic. With the rise in fuel prices, inflation, and general living expenses. It’s time to get a budget in place to manage your daily expenses and free up some fun money!

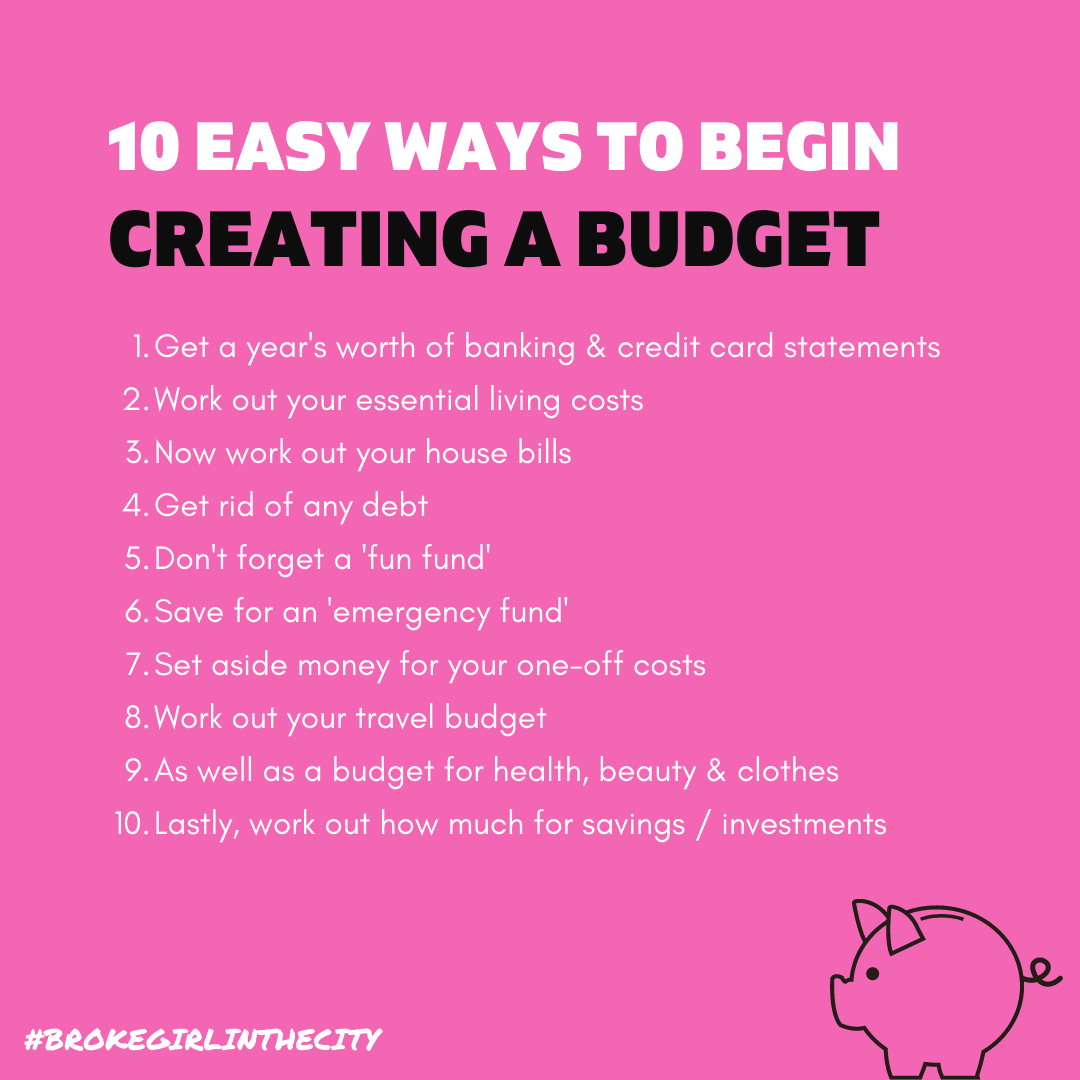

10 ways to begin creating a budget this year

I would allocate an hour or so to go through this list, to be able to look at your expenses throughout the year. It’s empowering to feel in charge of your finances, and ready for the start of February! If you have started one already – that’s great! It’s always good to check them and make sure they are realistic and you have captured all costs. If you haven’t started a budget, then take a look at my list below to start building one out for the forthcoming year.

1. Get together a year’s worth of Banking & Credit Card Statements

It’s good to look through a year’s banking and credit card statements to see your total outgoings and expenses. You may also be able to notice subscriptions coming out that you forgot you had signed up to! I also managed to cancel a rogue payment of £98 that had come out of an Amazon Account that they had to close down – and I had to re-order a new bank card. I have all of my banking apps on my phone so I can check my finances at any one time.

2. Work out your essential living costs

Whenever you set yourself a budget, you need to work out your basic costs first which will include council tax and rent. You need somewhere to live and Council Tax is one bill you can’t afford to get into arrears on. If you have ever fallen behind on any of these, it’s time to get professional help. You will have needed to work out a budget before you approach anyone, so it’s good to get this in place. Once your essentials are accounted for, it’s time to then work out all other bills.

3. Now work out your house bills and other costs

I have separate bank accounts for different things. I have a bank account for bills with my housemates, which we pay in to each month. I also use Monzo as a separate bank account for daily spending, and it categorises this so I know where my money is going. I also allocate my weekly spending into weekly pots and then transfer it at the start of each week. This tip will stop you from spending your monthly budget all at once!

4. Let’s get rid of any debt

Debt can be crippling and once in a downward spiral, it’s difficult to get back out of it. I have spent years paying off the minimum payment, but this year I plan to pay off my credit card statements in FULL each month. Last year I got myself into debt once again being out of work, and I spent the last few months paying off £6,000 worth of debts to make sure I started 2022 once again debt-free. You need an action plan. Once you have all of your debts into a spreadsheet, include the APR (annual percentage rate) as you may be paying a higher interest rate on some of these debts.

5. Don’t forget to budget for a ‘fun fund’

You need to have some fun in your life so make sure you work out your birthdays and other events you need to budget for. Budgeting isn’t just about taking away from your life. it’s about juggling your money to make sure you do have money for important events in your life.

6. Save for an ’emergency fund’

If you do not have an emergency fund, then try to factor this into your annual budget. I have been caught out a number of times in my life, where I was paying off debt so aggressively, I then had no spare cash for when things went wrong! It’s important to save, even if it is just a small amount.

7. Set money aside for one-off costs

Whether it is money for a car or subscription costs. Make sure you set aside money for the month any one-off cost is due, so you are not caught off-guard when this comes out of your account. January is a month when lots of bills come through, but you may also have other costs come through during the year. Go through your bank accounts and credit cards to work these out.

8. Work out your travel budget

You may have been working from home this year, or agreed on a hybrid way of working. Some of you may have been furloughed, or have been working throughout the pandemic. You may need to work out a new travel budget now that many businesses require people to work full-time from the office or other places of work.

9. As well as for health, beauty & clothes

I need ongoing medication for my asthma so I pay for a pre-payment certificate which is only £10.65 a month. I used to pay around £40 a month for my medication, so this is a great money hack! Also, factor in money for clothes – I have had to buy a whole new wardrobe as my shape changed during lockdown. I don’t often treat myself to new makeup, but I have started to get my hair done professionally, which has been a huge expense. I am working out what my monthly expense should be, to budget for these sorts of expenses.

10. Work out a budget to save/invest

You may not have any wriggle room to be able to save, but as long as you are saving something, then that’s an achievement. I have decided to do the £5,000 savings challenge, and am using my Starling Bank Account to save on a weekly basis.

Other articles of interest

The Budget Planner – by MoneySavingExpert

I like this version and it’s designed so that you can enter your income and outgoings by month or by year, to work out an annual budget. It will guide you as to whether you are in the ‘red’ (your outgoings are more than your income) or whether you are in the ‘green’ (your outgoings are less than your income).

Click to start your Budget Planner