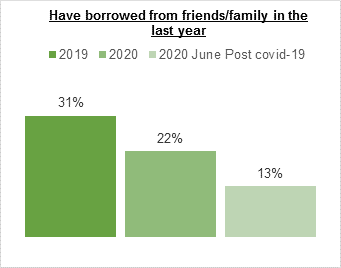

Borrowing money from friends and family has reduced significantly since 2019. Even more so following the lockdown.

58% decrease in borrowing, and a 52% decrease in lending, since March of last year.

- Borrowing money from loved ones dropped by a third in the last year, then a further 40% during lockdown

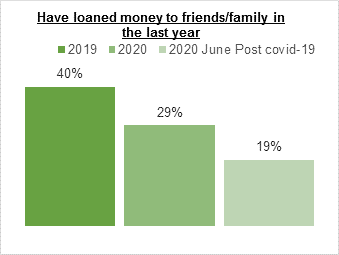

- Lending money to friends and family reduced by over a quarter in the last year, and then a further third during lockdowN

- The main reason for borrowing from loved ones is to pay off other debts

According to the latest How Britain Lives research from Lloyds Bank, borrowing significant sums of money from friends and family reduced by 29% between March 2019 and March 2020. Then by a further 40% throughout lockdown.

Just 13% of people have borrowed money from friends or family in the last 12 months, compared to 31% who had done so in March 2019. (See graph 1).

Lending has also seen a significant decline

The loaning of money to loved ones was reduced by 28% between March 2019 and March 2020. Then by a further 34% over the months of lockdown. Just under a fifth (19%) have lent money to loved ones in the last year compared to two-fifths (40%) in March 2019. (See graph 2).

People are less likely to turn to loved ones for cash

Across all age groups, there has been a substantial reduction in people turning to loved ones for extra cash (see Graph 3).

18-24 years olds are the most likely to lean on friends and family for financial help. Borrowing amongst this group has dropped from over half (51%) to 1 in 3 (30%).

“This significant shift in loved ones borrowing or lending money to each other suggests that financial uncertainty has been compounded by the pandemic, with people now much less likely to be reliant on each other.

“Even given the difficulties young people can face in achieving milestones, like buying their first car or house, there has been a concerted effort not to borrow from the Bank of Mum and Dad. We expect to see this change over the next 12 months, as people try to balance the financial fallout of COVID-19, with wanting to move forward with life plans after months of restrictions.”

Jo Harris, Managing Director, Lloyds Bank

Debt consolidation is the main reason for borrowing money recently

The main reason for borrowing money recently is debt consolidation, with 16% of people citing this as the reason. The second most popular reason was the purchase of a car (14%), followed by home improvements (12%).

The biggest loans from family and friends were for cars (£3,630 loaned on average). Followed by weddings (£3,226), and home improvements (£2,846). The average amount borrowed for debt consolidation was £2,563.

Family and friends who have been lending money are much less likely to be happy about doing so. With just 51% saying they were pleased to be able to help someone out. Compared to 61% in 2019, and fewer people expect to be paid back than in 2019 (42% vs 43%).

Regional variations:

Those in Wales are the least likely to borrow money from loved ones. Only 5% say they have done so in the last 12 months, an 83% reduction since 2019. The regions seeing the most borrowing from friends and family are the South West, and the North West, where 15% continue to do so. (Table 1).

Methodology:

YouGov fielded a quantitative survey to a nationally representative sample of the UK population. Interviewing 5,184 UK panellists who agreed to take part in the research in March 2020. Then conducting a follow-up quantitative survey in June 2020 amongst a similar sample profile in the UK, interviewing 5,160 UK panellists

This research is part of a wider series from Lloyds Bank called ‘How Britain Lives’. A major study looking into the issues that British people face in today’s modern world includes insight into their lives, attitudes and daily pressures.