2.3 million will be pushed into the red by October’s Universal Credit cut say Citizens Advice

- Citizens Advice warns frontline services are bracing for wave of hardship this autumn

- Dame Clare Moriarty says, “Cut will be a hammer blow to millions of people”

New research from Citizens Advice reveals the potential impact of a cut to Universal Credit on 6th October. The increase was introduced to help those who were vulnerable during COVID times.

Read my top tips on how to survive the Universal Credit cut below.

Temporary coronavirus increase to UC has now ended.

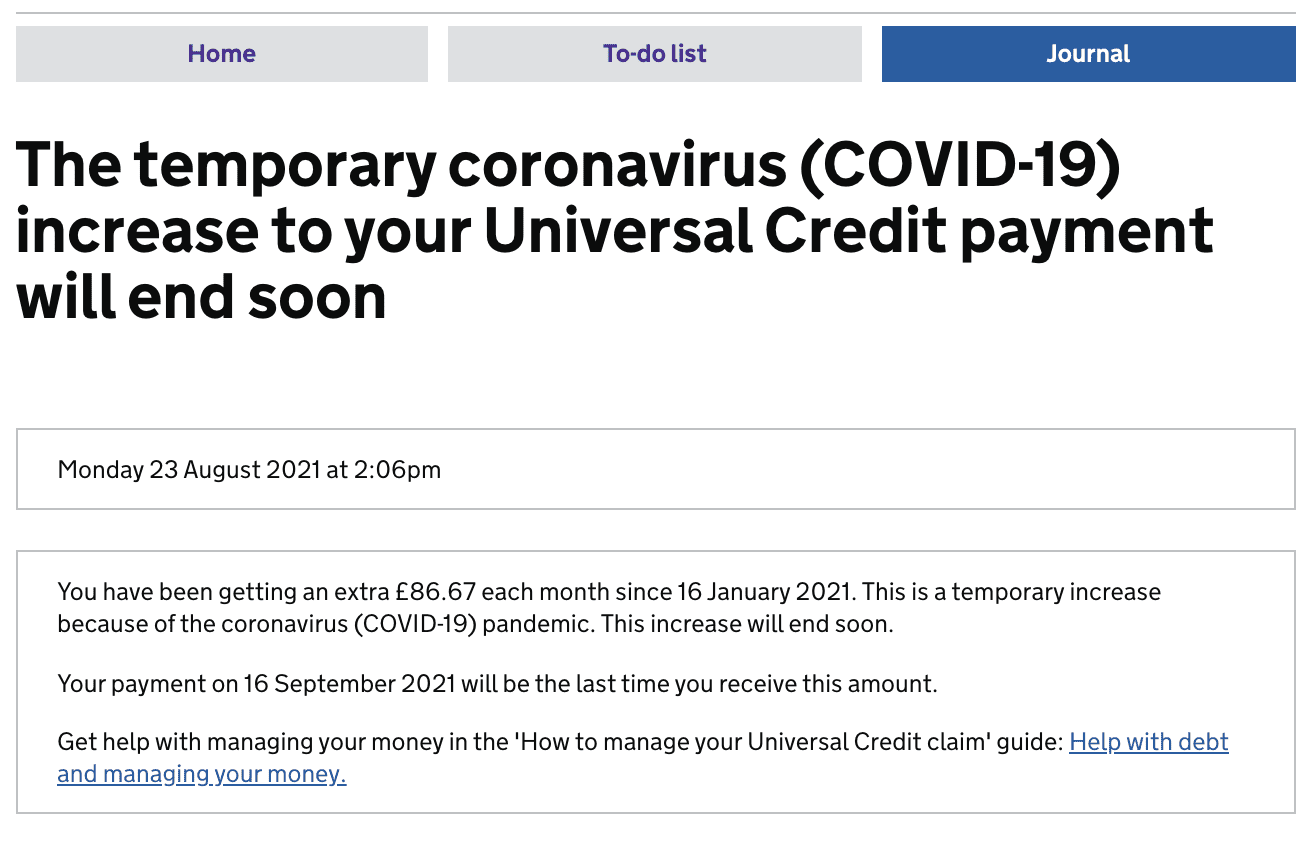

I wanted to show you how this translates into an individual’s monthly Universal Credit payment. Many people had to sign up for Universal Credit for the first time this year, but many people and families depend on UC as their financial lifeline. Below is a real snapshot that is taken from a Universal Credit platform to show you the disparity between how much is paid on a monthly basis.

The Universal Credit payment message above is what was sent out in September. If you look at the table below, it outlines the payments for anyone claiming Universal Credit at the moment. £86.67 a month is a significant amount for anyone who is on Universal Credit. Whilst you can claim for support with rent separately. All bills, food and transport costs must come out of this payment, which is not easy to live on month to month.

| Your circumstances | Monthly standard allowance |

|---|---|

| Single and under 25 | £342.72 |

| Single and 25 or over | £409.89 |

| In a couple and you’re both under 25 | £488.59 (for you both) |

| In a couple and either of you is 25 or over | £594.04 (for you both) |

Should the Universal Credit scheme be extended?

In February I wrote about the scheme being extended. In an appeal by the Work and Pensions committee to Parliament, they called for the £20 per week increase in Universal Credit Working Tax Credit introduced to support families during the coronavirus pandemic to be maintained for another year at the very least. However, the Government has concluded that this was only a temporary payment increase and will no longer be supported.

Citizens Advice Survey

A survey of over 2,000 people on Universal Credit shows more than a third (38%) would be in debt after paying just their essential bills if their benefits drop by £20 a week. This is equivalent to at least 2.3 million people.

The figures come as frontline advisers say they are preparing for a surge in people seeking ‘crisis support’ this autumn. Citizens Advice warns of a triple whammy of benefit cuts, rising energy bills and further redundancies as the furlough scheme also ends in September, which will push individuals and families into hardship.

The charity has helped three people a minute with one-to-one advice on Universal Credit since the pandemic began. Nine in ten of its advisers say they anticipate an increase in people needing support from food banks if the Universal Credit cut goes ahead.

365 frontline staff at Citizens Advice participated in the Network Panel survey in July 2021. 88% of respondents agree that people helped by Citizens Advice will need to rely on foodbanks if a £20 per week is cut from Universal Credit. 95% said single parents would be negatively affected by the cut.

‘We’re gearing up to provide more crisis support’

Charlie Young, Project Manager at Arun and Chichester Citizens Advice

Charlie Young, Project Manager at Arun and Chichester Citizens Advice, says:

“So many families we’re helping are just about managing to scrape by. Take away £20 a week and you push them into the red. It’ll be devastating.

“We’re gearing up to provide more crisis support if the cut happens. That means foodbank referrals, fuel vouchers and helping parents of babies and toddlers get access to nappies and milk.

“This type of support is critical, but ultimately nothing can plug the gap that will be left in people’s budgets if that extra money is taken away.”

‘I would have to go down to one meal a day to make sure my son has enough to eat’

The charity’s frontline advisers have spoken of particular concerns about single parents being hardest hit by a drop in income given their essential outgoings.

“A cut to Universal Credit this autumn will be a hammer blow to millions of people.

Dame Clare Moriarty, Chief Executive of Citizens Advice

“It undermines our chance of a more equal recovery by tipping families into the red and taking money from the communities most in need.

“The government must listen to the growing consensus that it should reverse course and keep this vital lifeline.”

How to manage your finances after the Universal Credit Cut

Whether you rely on Universal Credit to top up your income or are reliant on it as your only source of income. The £20 decrease is a significant figure. It is incredibly stressful and when you thought you couldn’t survive on any less money, the payment increase has finally been withdrawn despite the Government being petitioned on this.

1. Check what benefits you are entitled to

Every council operates differently and so it is worth finding out what you are entitled to. Many will offer discretionary hardship grants but you need to ask after these. The Warm Home Discount provides a £140 rebate on energy bills each winter to over 2.2 million low-income households. The Cold Weather Payment provides £25 extra a week for vulnerable households when the temperature is consistently below zero. The Government also plans to offer meals and activities to families over Christmas. Read more.

2. Government launches £500m support for vulnerable households over winter

Vulnerable households across the country will be able to access a new £500m support fund to help them with essentials over the coming months as the country continues its recovery from the pandemic. This new fund will run over winter and those in need of support should contact their local council who will help them access the fund. Read more.

3. Prioritise your debts

Prioritise your basic needs: I recently spoke on BBC Radio 5 Live with Laura Whitmore about how to set up your budget. Always prioritise rent, food and bills. These are your “basic needs”. Then ring-fence this money and put it into a separate bank account. If you are in debt, you don’t want the money for rent to be in the same bank account as debt repayments.

Manage your debt repayments: Anything else such as credit cards, and loans fall into the non-priority debts category. As long as you are making a token payment, they will not be defaulting against these payments.

Set up a budget: It’s important to look at the month ahead – your income and outgoings. Once you have taken your priority needs payments from your income. See what you have left. You may need to negotiate a repayment plan with creditors which you can do yourself, rather than engage an agency. Leading charity advisor Stepchange can also help you with this if you feel you are unable to manage all of this yourself. Read more.

Don’t leave your situation to get worse. As daunting, and perhaps scary as it seems. Taking action now will help in the long term.