Monitor your credit score & affordability

I would pay Experian a monthly fee of £14.99 to monitor my credit score for years, which flatlined at ‘Very Poor’. I had maxed out my credit cards and would pay the minimum payments each month. Only for me to then spend any difference there was on the card. Over the last 12 months I have been paying my monthly loan back, but was unable to pay anything off my credit cards. It was only when I started a new job in January, did I use my monthly income to pay off my loan in full and start attacking my credit cards.

MoneySavingExpert.com Credit Club – a totally free way to check your credit score.

Checking your credit score is completely free!

According to MSE, your credit acceptability impacts far more than just whether you’ll get mortgages, loans or credit cards. It also affects how good a deal you’ll get for other things. Such as gas and electricity, mobile phones.

MSE launched its own Credit Club, so you can now access your own free Experian Credit Score. Plus your unique Affordability Score, Credit Hit Rate and tips to boost them.

A credit score alone isn’t enough – what counts in the real world is, will you be accepted?

A credit score is a key indicator of your creditworthiness. But that’s just one piece of the jigsaw. Credit scores exclude crucial information such as income. So even if you’ve got the best credit score, if you can’t afford a product, you’ll be rejected. The Credit Club includes other metrics such as your Affordability Score and Credit Hit Rate that incorporate these.

Wallet workout

I started the 2mins Wallet Workout. I attempted to apply for a credit card (balance transfer), which according to Money Saving Expert I am 90% eligible for. Typically it says that in 5 days I will find out the decision. Eek.

5 main Credit Club tools:

I receive a monthly free email each month with updates on my scores. I am committed to improving this over the next year.

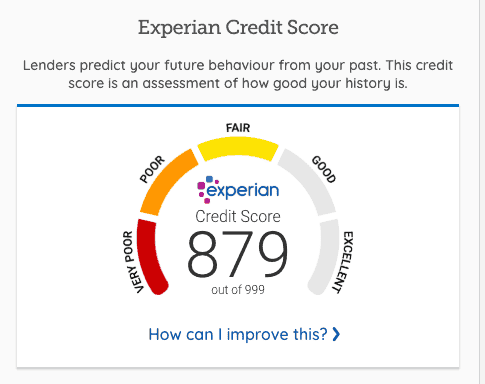

May 2018: Check out my Experian Credit Score. It once flatlined at ‘Very Poor’ – now is it is fair, which to me is a big achievement.

July 2019: Now check out my Experian Credit Score. Over the past year, I have reduced my spending and improved my finances. The one thing that is setting me back is that I still don’t pay my credit cards in full each month. Something that I intend to do by this time next year.

1. Free Experian Credit Score:

Your credit score analyses how a typical lender views you based on your payment history, applications, the credit you have and more. Experian is the biggest credit reference agency which deals with a majority of lenders.

2. MSE’s unique new Affordability Score:

MSE’s affordability score is something lenders do, but isn’t part of any public credit score. For the first time anywhere (that we know of) MSE mimics the way lenders check if you can afford a product, by looking at factors such as your income, exposure to debt and estimated expenditure. And we’ve also specific affordability scores for loans, credit cards and (coming soon) mortgages.

3. Credit Hit Rate in the real world:

Your credit report, combined with your affordability, dictates the likely acceptance of future credit. MSE’s Credit Hit Rate shows the percentage of a basket of top deals you’re likely to get in the real world.

4. Credit Cards & Loans Eligibility Calculator:

Every application you make for a product leaves a mark on your credit report. Yet the only way to know if you’ll be accepted is to apply. Here we break that catch-22 system by showing, product by product, what your odds are of getting each top deal – letting you home in on the best without impacting your creditworthiness.

5. What you need to know about YOUR credit profile:

This is crucial information showing how strong your credit profile is and where it’s weak, which may enable you to improve it.

Martin says: “The team and I have been working on this for a long time. We’re planning to add a lot more, but it’s got to the stage where I think there’s a vast amount of unique information already, so it’d be wrong to hold it back any further.

MSE future plans include…

- A free full credit report. You’ll be able to see your Experian Credit Report in detail, too, to check line by line.

- How have your scores changed over time? A timeline showing how each score has changed to monitor progress.

- How you compare with others. This allows you to benchmark how you’re doing compared with everyone else. After all, a 72% hit rate may not seem brilliant, but it’s pretty good if only 1 in 1,000 people get it.

- Detailed help is specific to you. The aim is to analyse your situation and present the right tips, guides, articles and videos on how to improve your file.

Credit Club FAQs